Trading Stocks- Basic

Stocks

When you buy stock in a company, you buy part ownership in that company. As a shareholder or stockholder, you benefit from certain privileges that come with ownership. You may also prosper from the company's success, through dividend income or by selling your stock once it has increased in price.

However, while a stock price can increase indefinitely, it can also decrease. Owning a piece of the company also means you may lose some or all of your initial investment if the company does poorly and its share price drops.

Over time, share prices in companies fluctuate in response to changing conditions in the economy and investor sentiment. As a result, many regard stocks as a risky investment. Yet, historically, stocks have achieved more impressive returns over the long term than any other traditional investment category. Learning the techniques of trading and the factors that affect stock performance can help you invest with confidence.

Stock Dividend

A stock dividend is the payment a trader receives from the company he/she is currently investing in.

The company pays the dividend from the profit it generates throughout its financial year. As a result, if the company fails to make a profit, dividends are not likely to be received by the investor.

The dividend is normally paid in two parts, an interim and a final dividend. This means if an investor has shares in a company for a year, they will normally get paid two lump sums a year (almost always in the form of cash).

To receive a dividend you must own the stock before the ex-dividend date. The dividend gets paid to the investor on the payment date set by each individual company, these dates can be found on a company’s investor relations section of their official website.

- Dividend Example:

- if you own 200 shares in a company and they cost $32.33 each ($6,466 total) before the ex-dividend date

- and the company issues a dividend of $2.47

- you will be entitled to a payment of $494! (($6,466/$32.33)x$2.47)

By owning a stock before the ex-dividend date you will be entitled to the dividend regardless of whether you have owned the stock for 10 years, 10 months or 10 days!!

Note: Dividends are such a a good bonus that there are traders who only buy stock before the ex-dividend date and make their money on dividends rather than capital gains.

Dividend yield

The dividend yield (when referring to common shares) is the most recent full-year dividend / current share price. The figure is expressed as a percentage and indicates to traders the dividend they are likely to receive from trading a stock.

- An easier way of looking at it is:

- The share price of a company is $32.33

- The company offers a dividend of $2.47

- Therefore the dividend yield is 7.50%

- Meaning if an investor owned 1000 shares (worth $32,3300.00) they would be entitled to a $2,470.00 payout!

If you are looking to receive a form of income other than capital gains (i.e. dividends) then the dividend yield figure will help you pick out the companies paying the highest dividend. A simple search on a stock market practice account site will enable you to filter out the stocks with the highest dividend yield.

ADVFN.com lists the ex-dividend date of each stock, you then can save a list of high yielding stocks with their ex-dividend date and trade each stock just before the ex-dividend date arrives! Unless the stock drops considerably then this is a very easy way of making money!

Buying Long

Buying long is the traditional way to buy stock. When you hear your grandpa talk about the stocks he bought 50 years ago, he's talking about buying long. The stock you bought last year and held was also bought long.

The basic premise behind buying long is buying stock for the purpose of holding it to make a profit when/if the price goes up in the future. If the stock price does go up, and you sell the stock, you make a profit. If the stock price goes down, you lose money. It's the same concept as buying and re-selling a tangible asset. If you bought a Mickey Mantle card in mint condition for $50 and sold it today for $400, you would make a profit of $350.

Conversely, if the price of your stock goes down, you lose money. Sticking with baseball cards for the moment, that would be equivalent to paying $200 for a card thinking the player is going places and being forced to re-sell it for $10 when his career takes a nosedive.

However, regardless of how strongly you believe a stock's price will move in the direction you anticipate, you can never be certain it will. It's always important to understand all of the risks and costs associated with an options strategy before making an investment.

Selling Short

While most individuals invest in the market when they believe a stock's price will go up, some sell short because they believe it will go down. To sell short, investors open a margin account, borrow shares from their broker and sell the shares on the market. When the stock price decreases to a satisfactory level, investors cover the short position by buying the shares back (also called "buy to cover"). Their profit is the difference between the price at which they sold the borrowed shares and the price at which they repurchased the same number of shares in the market, plus the transaction costs and any additional fees.

The risks associated with selling short may be even greater than those associated with straightforward investing. If the stock price increases instead of decreases, you may end up paying much more to re-buy the shares so that you can return them to your broker than you realized by selling the shares. You may owe interest as well. There is a limited supply of shares available to short, and certain stocks may not be available to short.

Initial Public Offering

A private company must restrict its investors to a specific group, including its founders, employees and a group known as friends and family, and therefore has limited access to capital. When a private company goes public, it makes shares of stock in the company available for purchase to additional investors through an initial public offering (IPO). Although there are many motives for engaging in an IPO, many companies do so to raise additional capital to expand their businesses or create liquidity for their stockholders. Unlike a loan, a company is not required to pay shareholders back for their investment.

Secondary Market Trading

Once a company has gone through its IPO, investors buy and sell issued shares through intermediaries in the secondary market, which includes the traditional and electronic exchanges, as well as the over-the-counter (OTC) market, where transactions occur over the phone or on a computer. Companies with shares trading in the secondary market are required to regularly release reports describing their financial status, and any other pertinent information for the benefit of potential investors.

Corporate Actions

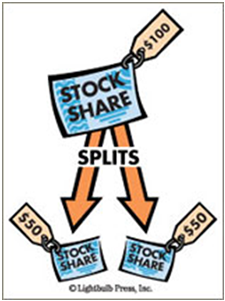

Stock Splits

When a stock's price increases significantly, investors may become reluctant to buy because they think the stock has reached its peak or because they believe it's too expensive. In this scenario, a company might decide to stimulate trading through a stock split. Splitting the stock will simultaneously increase the number of shares available for purchase and decrease the price. The total market value of the trading shares will remain the same.

Rights Offering

If a corporation issues new shares, it must give existing shareholders the first opportunity to purchase new shares. This is called a Rights Offering.

The existing stockholders have the opportunity to buy a proportional number of additional stocks at a given price (usually at a discount) within a fixed period of time.

Reverse Splits

A company might decide to increase its stock's price through a reverse split. Its motive might be to meet a stock market's minimum listing requirement or to make its stock attractive to institutional investors like mutual funds and pension funds, which do not typically buy low-priced stocks.

For example, in a one-for-two reverse split, the number of shares is cut in half while the price increases proportionately.

Warrants

A warrant gives the stockholder the right to purchase stock from the issuer at a specific price within a certain time frame. Warrants are similar to rights, but typically have a longer time horizon, usually measured in years.

Buy Backs

Just as it can issue additional shares, a company can repurchase, or buy back, shares of its stock. When a company repurchases shares, it takes them out of the secondary market and thereby increases each shareholder's relative stake in the company.

Reorganizations

- Mergers & Acquisitions - Mergers and acquisitions are two ways that companies can be reorganized and restructured. In a merger, two companies combine to form one larger company, while in an acquisition, one company is purchasing another company.

- Bankruptcy - Although no one buys stock in a company they expect to run into financial trouble, the reality is that some public companies do face bankruptcy and their investors lose all or part of their investment. One action a financially troubled or bankrupt company can take to attempt to revive its business is to undergo a reorganization.

- What a Corporate Action Means for Your Account - Any kind of corporate action or bankruptcy proceeding can affect a company's investors. Stockholders may be asked to exchange their shares for new shares in the reorganized company, sometimes for less value than their original investment. When a company is reorganized, the rights of investors are spelled out in the reorganization plan.

Learn More - Ask Questions?

The information contained in this website is for general information purposes only. The information is provided by MyStrategyBook and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Above information are owned by Scottrade® Knowledge Center and The Options Clearing Corporation.