Trading Options - Basic

What is an Options?

An option is a contract to buy or sell a specific financial product known as the option's underlying instrument or underlying interest. For equity options, the underlying instrument is a stock, exchange traded fund (ETF) or similar product. The contract itself is very precise. It establishes a specific price, called the strike price, at which the contract may be exercised, or acted upon.

Contracts also have an expiration date. When an option expires, it no longer has value and no longer exists.

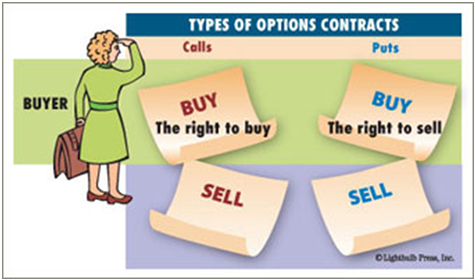

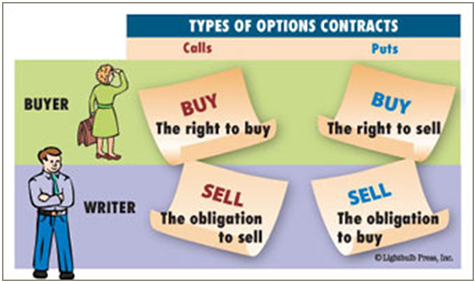

Options come in two varieties, calls and puts. You can buy or sell either type. You decide whether to buy or sell and choose a call or a put based on objectives as an options investor.

- Buying Options

- Selling Options

Buying Options

When you buy a call, you have the right to purchase the underlying instrument at the strike price before the expiration date. Buying a put gives you the right to sell the underlying instrument at the strike price before the expiration date.

Bullish investors tend to purchase calls, while bearish investors tend to buy puts. For example, if you believe the price of a stock currently trading at $50 a share will rise, you might buy a call with a strike price of $52. If the stock's price rises to $55 a share at expiration, you can purchase the shares at the $52 a share, or $3 a share under market value. Keep in mind, your profit is $3 a share less the cost of the option.

Alternatively, if you believe the stock's value will decline, you might purchase a put. If you choose an option with a strike price of $52, when a stock is trading at $55, and the stock's price drops to $49 at expiration, you have the right to sell the shares for $3 a share more than market value. Again, subtract the cost of the option from any profit you make.

As the option buyer, you control the ability to exercise the contract. However, the stock might not always move in the way that you expect. Should the price move in the opposite direction, you can do nothing and let the option expire worthless, or you may sell it to prior to expiration to recover part of your purchase price.

Selling Options

If you write, or sell, options, you have no control over what the buyer of that option decides to do. You're obligated to fulfill your side of the contract should the holder choose to exercise. If you sell a call and the option is exercised, you must sell the underlying at the strike price to the option holder. If you sell a put and the option is exercised, you must purchase the underlying at the strike price.

Option writers generally anticipate the stock will move in the opposite direction from option buyers or remain stable. Thus, it's often the call writers who tend to be bearish and the put writers who are typically bullish.

For example, if you sell a call with a strike price of $52 on a stock trading at $50 a share, you hope the price will either remain stable or lose value, leaving the contract worthless. Similarly, if you sell a put with a strike price of $52, you hope the price will stay above the strike price, so the buyer will not exercise and the contract will expire without any value. When the contract expires, you make a profit because you keep the premium, or the amount the buyer paid to purchase.

However, regardless of how strongly you believe a stock's price will move in the direction you anticipate, you can never be certain it will. It's always important to understand all of the risks and costs associated with an options strategy before making an investment.

What's an Assignment?

If you've sold a call that is exercised, you must deliver the shares to your brokerage firm. The Options Clearing Corporation (OCC) randomly assigns exercised calls to brokerage firms, and the firm that receives an assignment assigns it in turn to a client who has sold the contract in question. That client must meet the assignment, selling the agreed upon number of shares at the call's strike price.

Option Exercise Styles

Two Main Types of Options:

- American Style Options

- European Style Options

The distinction between the two has nothing to do with geography; rather, the owner's ability to exercise the option.

American Style Options - can be exercised any time between their purchase and their expiration. For example, if you bought an American style option that expired in 30 days, you could choose to exercise the option at any time between purchase and expiration.

European Style Options - however, can only be exercised at their expiration. Even if your option contract is in-the-money two days after purchase, you may not exercise it until it expires. After waiting for expiration, you may or may not find that your contract is still in-the-money.

With any option contract, American style or European style, you can always attempt to sell the contract before it expires.

Because of the freedom afforded by American style options, this type of option contract is generally more valuable than a European style option.

Underlying Instruments

The underlying instrument that determines the value of an options contract may be an investment, such as stock; a product such as wheat or oil, in the case of an option on a futures contract; or a financial instrument, such as an index. Since the term instrument is the broadest of the three, it's the one most commonly used in combination with underlying, although sometimes "underlying" is used alone.

Learn More - Ask Questions?

The information contained in this website is for general information purposes only. The information is provided by MyStrategyBook and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. Above information are owned by Scottrade® Knowledge Center and The Options Clearing Corporation.